Market Context

Macro Analysis Alignment

- Risk Mode Alignment: ALIGNED with provided risk-off mode

- Volatility Suitability: SUITABLE for current increasing volatility

- Liquidity Sufficiency: SUFFICIENT for trade execution

- Money Flow Compatibility: SUPPORTIVE to bearish pattern direction

- Macro Confidence Impact: Strongly supports bearish bias, increasing confidence in downside potential

Technical Environment

- Btc Influence: SUPPORTIVE to this bearish setup

- Sector Trend: WEAKENING

- Volume Profile: MIXED

- Correlations: High correlation with SPX, negative correlation with DXY

Pattern Critical Analysis

Classification

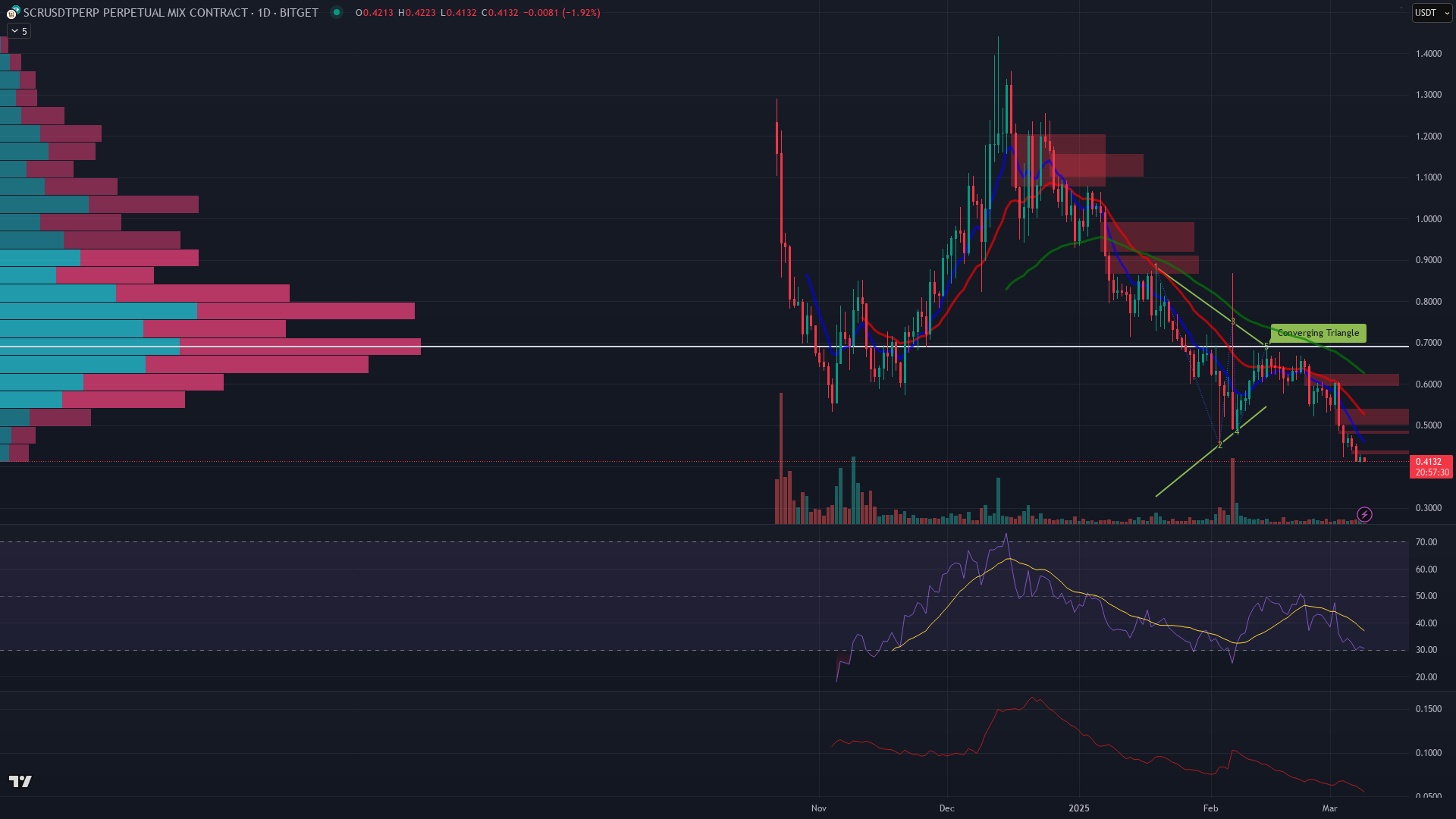

- Pattern Type: Descending Triangle (Contracting)

- Formation Quality: MODERATE

- Completion Status: PARTIAL

- Historical Reliability: Moderately reliable in risk-off, bearish environments

Technical Validation

- Rsi Confirmation: CONFIRMING bearish momentum

- Volume Confirmation: WEAK, lacking clear volume increase on breakouts

- Ema Relationship: Price below 20, 50, and 200 EMAs across timeframes, bearish

- Fvg Context: No significant FVGs visible in immediate price range

- Atr Context: Increasing volatility supports potential for sharp moves

Multi Timeframe Assessment

Timeframe Alignment

- H1 Bias: BEARISH

- H4 Bias: BEARISH

- Daily Bias: BEARISH

- Alignment Score: STRONG

Key Levels

- Support Zones: NA

- Resistance Zones: NA

- Liquidity Pools: NA

Probability Assessment

- Completion Probability: MODERATE (60-70%) - pattern aligns with macro but lacks strong volume

- False Breakout Risk: MODERATE - lack of volume increases risk of fakeout

- Stop Hunt Vulnerability: HIGH - 0.4300 level likely to be tested before further downside

- Time Decay Risk: Pattern should resolve within 48-72 hours, otherwise consider failed

Trade Decision

This post is for subscribers only